Few healthcare companies are more famous than Johnson & Johnson (NYSE: JNJ). The pharmaceutical giant earned its stature in the industry thanks to its incredible innovative abilities and a business that’s been executing for decades.

However, its growth has stalled in recent years. The company’s financial results haven’t been particularly strong, and it’s also dealing with a barrage of lawsuits and other legal challenges.

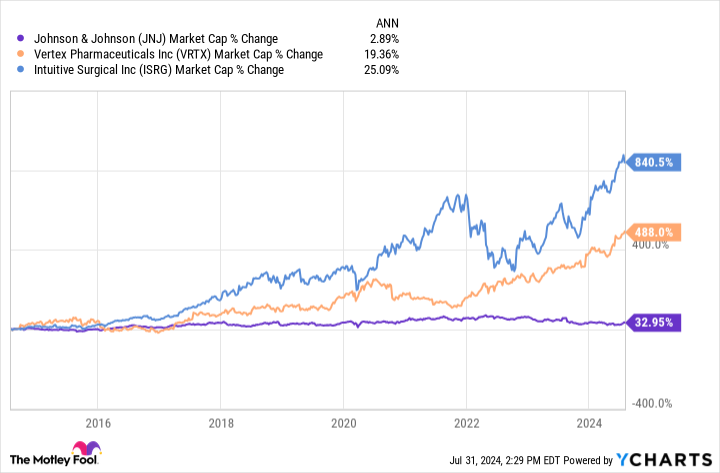

Though Johnson & Johnson remains one of the largest healthcare companies in the world by market cap, several others could overtake it within the next decade. Here are two prime candidates: Vertex Pharmaceuticals (NASDAQ: VRTX) and Intuitive Surgical (NASDAQ: ISRG).

JNJ Market Cap data by YCharts

1. Vertex Pharmaceuticals

At recent prices, Vertex Pharmaceuticals’ market cap was about $128 billion, compared to Johnson & Johnson’s $384 billion, so the former has a lot of catching up to do. But based on Vertex’s compound annual growth rate (CAGR) of more than 19% over the past decade — compared to less than 3% for Johnson & Johnson — the biotech could slow down considerably and still pull ahead.

Some might say that Vertex can’t pull it off. In the past 10 years, it has benefited immensely from its monopoly on drugs that treat the rare genetic disease cystic fibrosis (CF), but there’s far less room to grow in this area today. Further, Vertex might finally have to face competition in this field within the next five years.

These issues, though real, shouldn’t be too much of a problem. Vertex Pharmaceuticals is close to earning approval for yet another CF therapy — Vanza Triple — which will be an improvement over its current crown jewel, Trikafta. According to the research company Evaluate Pharma, Vanza Triple could generate $7.7 billion in revenue by 2030. (For context, Trikafta generated $8.9 billion in sales last year, though Vanza Triple will somewhat cannibalize its sales.)

The U.S. Food and Drug Administration is currently considering Vanza Triple for approval, which it could earn by January 2025. Vertex Pharmaceuticals has many other promising therapies that could gain approval soon. Suzetrigine, a potential pain medication that did well in phase 3 studies, could generate $2.9 billion in revenue by 2030, according to Evaluate Pharma. The biotech could also earn approval for inaxaplin, a potential medicine for APOL-1-mediated kidney disease, within the next three years.

Then there’s Vertex’s most recent approval, Casgevy, a gene-editing medicine for a duo of rare blood diseases with blockbuster potential. There are early-phase programs in Vertex’s pipeline that could be launched in the next 10 years — or even well before that. The biotech is working on a potential functional cure for type 1 diabetes that already looks promising in a phase 1/2 study.

Story continues

Vertex no longer has to rely exclusively on its CF franchise to drive growth. The biotech is expanding into other areas and is doing it well. Expect the company to deliver returns well above average in the next decade. It has a shot at overtaking Johnson & Johnson.

2. Intuitive Surgical

Intuitive Surgical’s incredible 25% CAGR in the past 10 years could allow it to pass Johnson & Johnson in this race. Yes the robotic surgery specialist — which markets the famous da Vinci system — has headwinds of its own that it didn’t have to face 10 years ago.

Intuitive Surgical’s bariatric procedure volume is declining due to the rise of anti-obesity medicines. Still, its top and bottom lines are moving in the right direction. In the second quarter, the company’s revenue increased by 14% year over year to $2.01 billion, and net earnings per share of $1.78 were up 25.3%, compared to the year-ago period.

Importantly, Intuitive Surgical’s instruments and accessories revenue was $1.2 billion, 15.7% higher than the prior-year quarter. The company’s revenue from instruments and accessories depends on the number of procedures performed with its da Vinci system and other devices — a number that keeps on growing despite the declining number of weight loss surgeries. It improved by 17% year over year in the first quarter.

In other words, this won’t be a massive problem for Intuitive Surgical, not by a long shot. Meanwhile, the company has plenty of growth opportunities ahead.

Just 5% of surgeries that could be performed robotically currently are. Intuitive Surgical is the leader in the field. Although some companies — including Johnson & Johnson — are increasingly trying to challenge Intuitive Surgical, it’s hard to imagine it losing its top stop in the foreseeable future. That’s partly because breaking into this industry is a long, capital-intensive process that also requires jumping through a series of regulatory hoops.

Intuitive Surgical has done that several times over — it recently earned clearance for the fifth generation of its da Vinci system in the U.S. This is one more reason why the company’s performance in the next decade should be impressive enough for its market cap to leapfrog Johnson & Johnson’s.

Should you invest $1,000 in Vertex Pharmaceuticals right now?

Before you buy stock in Vertex Pharmaceuticals, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vertex Pharmaceuticals wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $669,193!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 29, 2024

Prosper Junior Bakiny has positions in Intuitive Surgical, Johnson & Johnson, and Vertex Pharmaceuticals. The Motley Fool has positions in and recommends Intuitive Surgical and Vertex Pharmaceuticals. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.

Prediction: 2 Stocks That Will Be Worth More Than Johnson & Johnson 10 Years From Now was originally published by The Motley Fool