[ad_1]

Energy Transfer (NYSE: ET) has a lofty 8% or so distribution yield, which will likely sound pretty appealing to most dividend-focused investors. But don’t jump in just yet. You’ll probably be better off with Enterprise Products Partners (NYSE: EPD) and its still very attractive 7.2% yield. Here’s what you need to know.

Energy Transfer and Enterprise have similar businesses

Both Energy Transfer and Enterprise Products Partners operate in the midstream segment of the broader energy sector. Each of these master limited partnerships (MLPs) own the vital physical assets — like pipelines, storage, and transportation — that help to move oil and natural gas from where they are drilled to where they get used. Midstream assets tend to be very reliable cash generators.

In essence, the energy sector wouldn’t work without the assets that connect energy producers (the upstream) to the consumers of the commodities produced (the downstream). Midstream companies generally charge fees for the use of the assets they own, with demand for energy being more important than the price of the commodities flowing through their midstream systems. In fact, even when oil prices are low, demand for oil generally remains fairly robust since access to energy and a country’s financial prosperity go hand in hand.

So from a big-picture perspective, Energy Transfer and Enterprise are very similar businesses. But these two MLPs haven’t rewarded investors in the same way.

Who can you count on more?

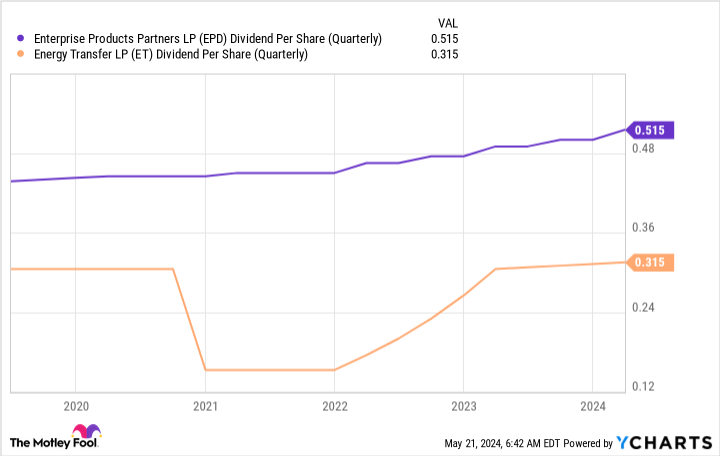

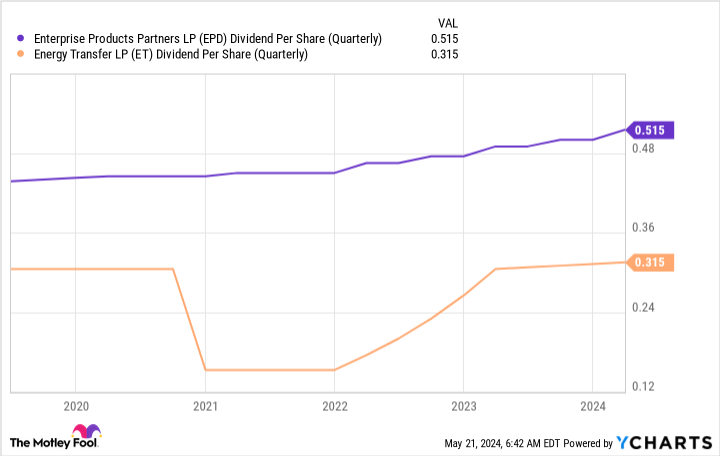

The most recent event that will likely lead investors to buy lower-yielding Enterprise happened during the coronavirus pandemic. Oil prices plunged as countries around the world were effectively shutting down their economies in an attempt to slow the spread of the illness. Basically, less energy was needed because less economic activity was taking place. In light of this and the uncertainty it caused in the energy sector, Energy Transfer cut its dividend in half.

That was a precautionary move made to ensure that the master limited partnership could survive through an uncertain future. But any investor trying to live off of the income their portfolio generated would have been thrown for a loop. And it could have been right when they most needed that income, given that employers in big sectors (most notably retail, a major provider of part-time jobs) were forced to shut down.

By comparison, Enterprise Products Partners didn’t cut its distribution. In fact, it has increased its distribution annually for 25 consecutive years. Clearly, if dividend consistency is important to you, you’ll prefer Enterprise over Energy Transfer every day of the week.

Story continues

Letting investors down in a different way

The next worrisome issue is unique to Energy Transfer. In 2006, it agreed to buy peer Williams Companies. But the energy sector hit some turbulence, which is fairly common for the historically volatile energy sector, and Energy Transfer got cold feet. Management stated that executing the deal would have resulted in a distribution cut, the need to take on a mountain of debt, or both. In its efforts to scuttle the deal, it issued convertible securities, with the then-CEO buying a large amount of the issuance. It is a bit complex, but it appears that the convertible would have protected the CEO from the distribution cut if the deal had gone through. That isn’t a particularly unitholder-friendly action and it would be understandable if investors had some trust issues here.

So far, nothing even closely comparable to that has happened with Enterprise. If you prefer your investments to be simple and for management teams to put shareholders first, the answer again appears to point toward Enterprise.

A few points of yield aren’t worth the extra baggage

Energy Transfer does have a higher yield than Enterprise Products Partners, but investors shouldn’t let yield be the final determinant of an investment; you have to consider the underlying business. When you do that, Energy Transfer probably isn’t going to be the best high-yield energy stock for most investors. Sacrificing a few percentage points of yield and buying Enterprise will likely allow you to sleep far better.

Should you invest $1,000 in Energy Transfer right now?

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $635,982!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Is Energy Transfer the Best-High Yield Energy Stock for You? was originally published by The Motley Fool

[ad_2]

Source link