[ad_1]

By Hannah Lang

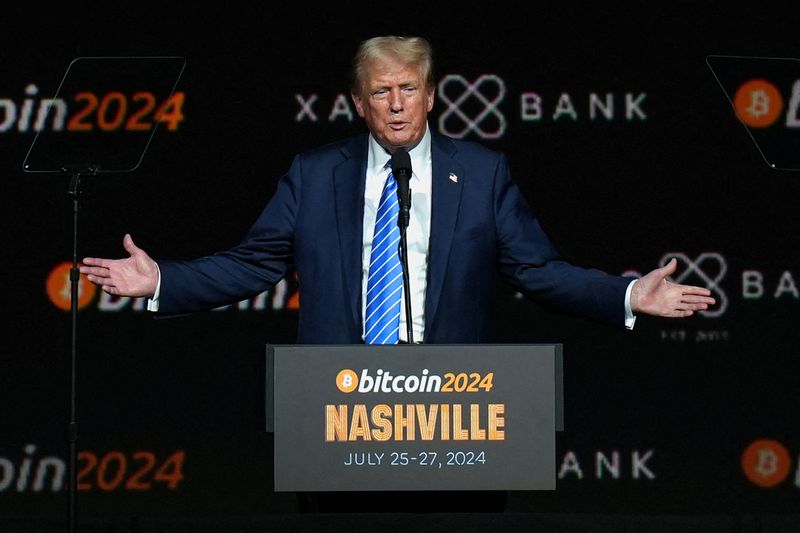

(Reuters) – When former U.S. president Donald Trump promised a bitcoin conference on Saturday that if reelected he would fire Securities and Exchange Commission Chair Gary Gensler, a crypto skeptic, the crowd roared with delight.

„Wow, I didn’t know he was that unpopular,” the Republican presidential nominee shouted over the cheers.

Trump, who once derided cryptocurrencies as a „scam,” is courting the industry and winning big checks from donors hoping he will swiftly end Gensler’s crypto crackdown.

Under Gensler, a Democrat appointed by President Biden, the SEC has brought dozens of crypto enforcement actions, including against major exchanges Coinbase (NASDAQ:), Binance and Kraken, and levied hundreds of millions of dollars in fines.

A Trump victory could change that virtually overnight. He could appoint a crypto-friendly chair to advance the industry’s wishlist, which includes spiking guidance that it says has limited Americans’ crypto custody options; a safe harbor for new tokens; and pulling enforcement actions.

„The most important thing we want out of a new administration is the nomination of individuals to key positions … that have an appreciation and an understanding of crypto,” said Kristin Smith, CEO of the Blockchain Association, an industry group.

Gensler’s spokesperson declined to comment.

Citing a Supreme Court ruling, Gensler says most crypto tokens behave like securities and should be strictly regulated in the same way, a position lower courts have mostly backed.

Crypto firms argue tokens are commodities and want new laws clarifying their status, although that could take years if Congress remains divided.

While Gensler’s term ends in 2026, Trump could replace him with another commissioner as acting chair. The likely candidate is Hester Peirce, a crypto advocate and the longer-serving of the SEC’s two Republican commissioners.

The industry is pushing crypto enthusiasts Brian Brooks and Chris Giancarlo, who served in Trump’s first administration, for the permanent job, executives said.

An acting chair could immediately rescind 2022 SEC guidance requiring public companies to account for crypto assets held on behalf of others as liabilities due to their riskiness. Banks struggle with this policy because strict capital rules require them to hold cash against liabilities.

Cryptocurrencies, with a market capitalization of around $2.5 trillion according to CoinGecko, would become more popular if consumers could store them with trusted lenders, executives say.

„I believe that’ll be rescinded Day One of the Trump administration,” said Cody Carbone, chief policy officer at the Chamber of Digital Commerce, a digital asset group.

The industry is also pushing for a safe harbor from SEC registration rules for issuing and trading crypto tokens, an idea Peirce floated in 2020.

„We need to look for a workable way to ensure both that token offerings can occur outside of the legal shadows and that token purchasers have access to the information they need,” Peirce told Reuters by email.

Smith said such a framework would be „incredibly positive.”

Giancarlo, who earned the nickname „Crypto Dad” when he was Commodity Futures Trading Commission chair, declined to comment on whether he would be interested in becoming SEC chair under a second Trump administration.

Until Congress acts, regulators have discretion to craft an interim regulatory regime that better serves the public and investors, he said. He also backed a crypto safe harbor.

„It would be an excellent place to start a new era of engaging with this innovation,” Giancarlo said.

Brooks did not respond to a request for comment.

Brian Hughes, senior advisor to Trump’s campaign, said in a statement the former president is prepared to remove „obstacles and unnecessary burdens” for crypto.

POLITICAL DEADLOCK?

A new chair’s power would depend, though, on the political weighting of the five-member commission which votes on rules, enforcement and other major issues. It is dominated 3-2 by Gensler and two other Democrats also critical of crypto.

While the president can replace an SEC chair with another commissioner, Gensler could still see out his term as commissioner. Even if he left, the four remaining members would be evenly divided initially, constraining a new chair.

Peirce said, for example, that she expected any safe harbor plan and major proposed changes to enforcement litigation, to go to a commission vote, suggesting approval might have to wait until Republicans take the majority.

Giancarlo said he would like a pause in enforcement actions where there is no investor harm, manipulation or fraud.

„I think the right approach would be to pause it … while the agency immediately turns to rule-writing in coordination with Congress and then give innovators time to comply,” Giancarlo added.

[ad_2]

Source link