Intel raised the curtain Tuesday on some new tech it’s banking will recoup some lost ground to its chip-making rivals.

At the annual Computex expo in Taiwan, the company announced a new generation of processors for data centers, pricing on its AI accelerator kits, and the architecture for an AI PC chip.

Intel boasted that its new Xeon 6 processors will deliver more performance and greater power efficiency for high-density, scale-out workloads in the data center than previous generations of the chip.

High performance at one-third the cost of competing platforms is the hallmark of the Gaudi 2 and Gaudi 3 AI accelerator kits revealed at the Taipei event, according to Intel.

“The combination of Xeon processors with Gaudi AI accelerators in a system offers a powerful solution for making AI faster, cheaper, and more accessible,” Intel noted in a statement.

Next-Gen AI PCs

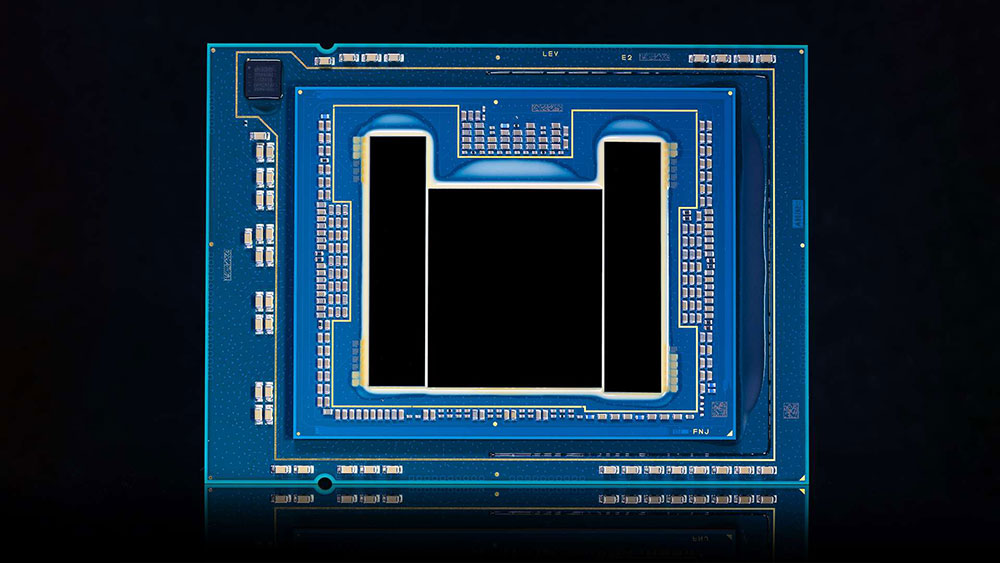

On the PC front, the company unveiled the architecture underlying Lunar Lake, which it sees leading the next generation of AI PCs, with no-compromise application compatibility and stingy power consumption — up to 40% lower than previous chip generations.

Intel’s next generation of the new mobile processor, code-named Lunar Lake (Image Credit: Intel)

“This showcases that Intel’s people have been working incredibly hard to reverse the mistakes of the last decade, and they’ve made impressive progress, but the race is far from over, and Intel’s competitors are equally focused and executing well,” said Rob Enderle, president and principal analyst with the Enderle Group, an advisory services firm, in Bend, Ore.

“The competitive result may depend on who stumbles first, and none of these vendors are stumbling at the moment,” he told TechNewsWorld.

“Intel has defined a broad strategy and is executing it very well,” added University of Pennsylvania Engineering Professor Benjamin Lee.

“Notably, all of these processor designs — Xeon, Gaudi, Ultra — have been developed and are expected to ship ahead of schedule,” he told TechNewsWorld.

Full Spectrum Reach

Intel CEO Pat Gelsinger maintained that Intel is one of the only companies in the world innovating across the full spectrum of the AI market — from semiconductor manufacturing to PC, network, edge, and data center systems.

“Our latest Xeon, Gaudi, and Core Ultra platforms, combined with the power of our hardware and software ecosystem, are delivering the flexible, secure, sustainable, and cost-effective solutions our customers need to maximize the immense opportunities ahead,” he said in a statement.

That full spectrum reach will help Intel deliver on its “AI everywhere” vision. “AI everywhere is a smart bet on different sizes of generative AI being the norm versus the Nvidia approach of ultimate performance and being applied to increasingly larger models and data,” Forrester Senior Analyst Alvin Nguyen told TechNewsWorld.

That kind of reach is also appealing to AI software makers. “It’s an advantage because it’s a singular architecture so, theoretically, you can have an app that runs from the PC all the way up to the data center,” said Jack E. Gold, founder and principal analyst of J.Gold Associates, an IT advisory company, in Northborough, Mass.

“If you’re moving from an Arm chip on a smartphone to a Nvidia chip in a data center with an app, there’s a lot of effort involved because you’re working with two different architectures,” he told TechNewsWorld.

Intel Strives To Regain Market Share

With its sixth-generation Xeon chip, Intel hopes to regain some of its lost share in the data center market. According to Reuters, Intel’s share of that market for x86 chips declined 5.6 percentage points over the past year to 76.4%, with AMD now holding 23.6% of the pie.

“Data center computing is Intel’s most important market, and continued advances in performance and power efficiency will be critical,” Penn’s Lee explained.

“The concern is that general-purpose processor design, like the Xeon, is increasingly commoditized,” he continued. “Engineers throughout the industry know how to define and refine these designs.”

“Moreover,” he added, “advantages in performance and power depend not only on the design but also the transistors used to build that design. Competitors, such as AMD, are also designing data center processors and building them with advanced transistors, leading to increased competition in this space.”

For companies updating their infrastructure, Intel Xeon 6 with Efficient cores (E-cores) enables 3-to-1 rack-level consolidation to reduce costs and save space. (Credit: Intel)

Shane Rau, a semiconductor analyst with IDC, a global market research company, noted that the new Xeon chips come in two flavors, the 6700 and 6900 series, each offering different combinations of performance and power consumption. “This product segmentation acknowledges that end-user workloads are diversifying and, depending on what workload an end-user has, they may need primarily performance or to balance performance and power consumption,” he told TechNewsWorld.

“So,” he continued, “Intel is expanding the kinds of workloads it can serve and trying to improve its competitive position against vendors of other data center processor types, including CPUs and GPUs from AMD and server GPUs from Nvidia.”

“More specifically, Intel is trying to position its server microprocessors to take on more AI-based workloads by themselves so that end-users won’t feel that they have to buy a separate server GPU to accelerate those workloads,” he said.

High Hopes for Lunar Lake

Intel also has high hopes for Lunar Lake. “Intel has reason to believe that Lunar Lake might catapult them back into a leadership position against Qualcomm and AMD,” Mark N. Vena, president and principal analyst at SmartTech Research in Las Vegas, told TechNewsWorld.

Lunar Lake chips feature advanced AI integration at the hardware level, optimized for AI workloads, setting them apart from AMD’s and Nvidia’s more traditional approaches, he explained.

The architecture also promises superior performance per watt, focusing on energy efficiency, potentially outperforming AMD’s Ryzen and Nvidia’s Grace CPU in sustained workloads, Vena added, and it’s supported by a comprehensive software ecosystem for AI development, competing directly with Nvidia’s CUDA and AMD’s ROCm platforms.

“Unlike Nvidia, which primarily targets data center applications, Lunar Lake chips are designed for consumer PCs, making AI-powered applications more accessible to everyday users,” he said. “Intel’s push with Lunar Lake could pressure AMD and Nvidia to enhance AI integration in their consumer products, driving competition and innovation in the AI PC market.”

Gold predicted that 65% to 75% of PCs in the market will be AI-enabled within two to three years, maybe even higher in the enterprise as they upgrade their machines. “So what Intel is doing in that space is important,” he said.

“But Lunar Lake isn’t just about AI,” he added. “It’s about significantly reducing power requirements because [consumers] want thin and light machines with batteries that last two days, three days, a week.”

Addressing Power Shortages in AI’s Future

Power is going to be a looming issue in AI’s future, maintained Deborah Perry Piscione, co-founder and CEO of the Work3 Institute, a research and advisory services provider in San Francisco. “One of the most important investments will need to be in our 40-year-old energy infrastructure,” she told TechNewsWorld.

“Policymakers are going to need to move fast on supporting AI development and not be behind the eight ball like we were with fabs for semiconductors,” she continued. “We all paid the price with the semiconductor shortage during Covid, and we will continue to pay the price on our energy grid.”

“The success of AI development and our ability to consume it is all a big ‘if’ right now,” she said.