[ad_1]

When I covered ZIM Integrated Shipping Services (NYSE:ZIM) stock a month ago, it was trading at $10.24. Today, shares in the Israeli company trade for $19.18. The stock has surged 88% over the last month, as sentiment improved and analysts noted strong tailwinds in the container shipping sector. At the current price, I’m neutral on ZIM, as there’s a chance that the ZIM ship has sailed. Despite the positive transformation the company appears to be on, I just need more data to justify the surging share price.

Sector Tailwinds Helping ZIM

Analysts remain optimistic about the container shipping industry, and recent broker notes have contributed to the improving sentiment around ZIM. These institutions have pointed to increased shipping from Chinese ports — the world’s largest exporter of container goods — and rising freight rates partially due to attacks on maritime trade.

In early May, the Shanghai Container Freight Index (SCFI), which tracks shipping prices from major Chinese ports, was up 31% year-to-date and 72% since mid-December, marking the highest level of the year so far. Meanwhile, Jefferies analysts, led by Omar Nokta, noted that “freight rates have surged after a brief lull across major trade lanes, with this momentum spilling over to secondary routes.”

With Houthi attacks on vessels transiting the Bab-el-Mandeb Strait, coupled with low water levels on the Panama Canal, analysts have also highlighted that rerouting is eating up spare capacity. According to Jefferies, 90% of normal Red Sea freight is being diverted around South Africa.

Jefferies also suggested that the seasonal pick-up in demand has been earlier than usual. Noting that peak shipping season normally spans the months from June to September, the brokerage suggested that an early scramble for capacity indicated that freight rates would likely remain high throughout Q2.

ZIM’s Red Sea Guidance

ZIM has also noted that these disruptions are having a positive impact on realized rates. In its Q4 report, management highlighted that the effects were yet to be seen in the reported quarter but guided towards higher freight rates in Q1 and Q2.

“In November 2023, we anticipated rates to remain flat through 2024 amid a supply-demand imbalance. Today, the SCFI is over 80% higher as the longer voyages around the Cape are estimated to have absorbed 6% to 7% of global capacity, creating a more balanced supply-demand equilibrium.”

ZIM, echoing comments made by Jefferies, said that these diversions had soaked up some oversupply in the market and had pushed rates higher for certain trade routes. It also added that restrictions on vessel transits through the Panama Canal had added to the squeeze.

Story continues

Across the sector, from container shipping to tankers, companies have been cautious when providing guidance relating to these elevated shipping prices. After all, even the top geopolitical consultants can get their forecasts wrong, and we’ve certainly seen that in recent years. However, five months into 2024, vessels are still being rerouted and freight rates are high.

ZIM’s Transition to Success

No analysis of ZIM is complete without a dive into the company’s transition. The company is looking to replace its legacy fleet with a younger, more fuel-efficient one that is better suited to its routes. The transition involves the delivery of 46 new vessels on long-term charter agreements, 28 of which are LNG. As of the Q4 earnings call on March 13, management said that 24 had been delivered and that 22 would be delivered throughout the rest of 2024.

“Our core fleet will be modern, larger, and better suited to the trades in which we operate. Our cost per TEU is declining as we continue to take delivery of the cost-effective newbuild tonnage and redeliver expensive COVID-era vessels. We expect further improvement moving forward,” management noted. However, the downside is that debt, or the lease liability on the balance sheet, has continued to rise and is expected to continue rising until the delivery of the last vessel.

Earnings Are Coming Up

ZIM’s earnings report for Q1 is expected on May 21, and analysts are relatively positive. There have been two positive revisions in the last 90 days and no negative revisions. Analysts expect ZIM to report normalized earnings per share (EPS) of $1.93 or GAAP EPS of $1.54. Analysts are expecting revenue of $1.62 billion.

Is ZIM Stock a Buy, According to Analysts?

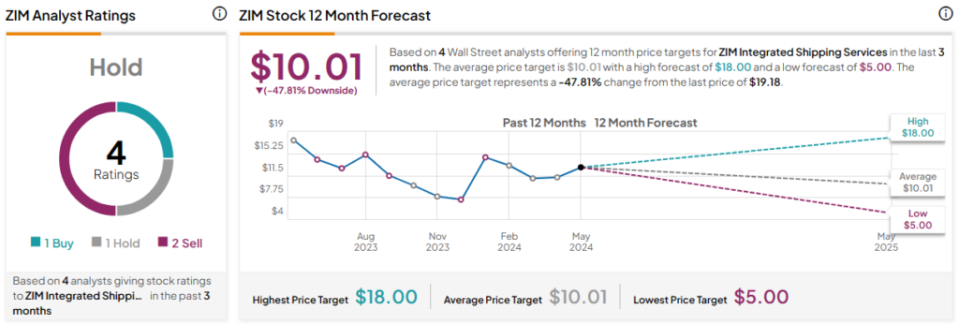

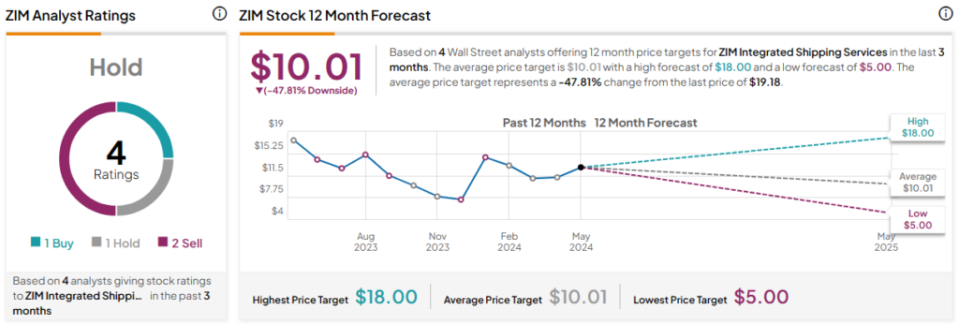

ZIM stock is rated as a Hold, according to the four Wall Street analysts offering 12-month price targets in the last three months. There is currently one Buy, one Hold, and two Sell ratings. The average ZIM Integrated Shipping Services stock price target is $10.01, with a high forecast of $18.00 and a low forecast of $5.00. The average price target represents 47.8% downside potential.

The Bottom Line on ZIM Stock

At the current price, I’m undecided on ZIM stock. The company is likely to be performing well at this moment in time, given the inflationary impact of rerouting on freight rates. Coupled with strong data from China, ZIM’s earnings could be in overdrive. However, I need to see more evidence to justify the 88% rise in the share price since I last covered the stock.

Disclosure

[ad_2]

Source link